Post-Purchase Surveys: Definition, Types, and Examples for Shopify Brands

While each stage of the buyer’s journey is important, few are as critical as the post-purchase stage.

Oct 29, 2024 | 19 minute read

Lindsay Kolinsky

Director of Marketing

While each stage of the buyer’s journey is important, few are as critical as the post-purchase stage. The customer experience doesn’t stop once a buyer clicks “buy.” In actuality, if you’re doing things the right way, the post-purchase stage is just the beginning — where a one-time purchase leads to a repeat customer, boosts loyalty, and increases customer lifetime value (CLTV). With the cost of acquiring a new customer now five times more than retaining existing customers, this is something that should resonate with all brands.

Optimizing your post-purchase stage doesn’t just help you strengthen relationships with existing customers. With the right post-purchase strategy in place, Shopify brands can unlock key insights that enable them to hone their offerings in a way that can also attract new customers.

So what exactly does optimizing the post-purchase stage look like? Well, as is the case with so much of what it takes to be a successful online seller today, it starts with data. The post-purchase stage provides a huge opportunity to collect actionable insights during the checkout process that can be used to measure the effectiveness of your offering, your marketing strategies, and allows you to develop a deeper understanding of your customers.

In this article, we’re covering a foundational element of any post-purchase strategy: post-purchase surveys. We’ll take a look at real examples from brands and how to get started with post-purchase surveys in Okendo.

What is a Post-Purchase Survey?

A post-purchase survey is a question (or questions) for customers after they make a purchase from your brand. The surveys include questions about the customers’ experience, their preferences and behaviors, market research questions, where the customer first heard about your brand, and other valuable customer feedback.

Why You Need Post-Purchase Surveys

Post-purchase surveys have always been an integral part of how ecommerce brands collect valuable insights after a customer buys a product. They allow merchants to identify the things they’re doing right, what they’re doing wrong, and help form a deeper understanding of customers and their user experience- All things that are crucial in scaling a modern ecommerce business.

But today, against a backdrop of complexities, post-purchase surveys aren’t just a value add to a brand’s insights collections strategy – they’re a must-have.

Calls for privacy have led to major platform shifts that have changed how brands can access and use customer data. These shifts are forcing ecommerce businesses to wean themselves off tech platforms’ ability to feed them data for a fee and find new ways to collect zero-party data (ZPD) by going straight to their customers.

With their 50%+survey response rates and low lift implementation, post-purchase surveys have become one of the most effective ways of gathering these mission-critical insights. And as we mentioned, these insights can be used in a multitude of ways.

What Can You Discover With Post-Purchase Survey Data?

Post-purchase surveys are the treasure-hunting technology of the ecommerce world. They allow you to dig into areas where you have limited visibility and pull out valuable material. And just as treasure hunters use devices that can locate an array of materials, post-purchase surveys allow marketers to dig up gems related to several areas that are a critical part of any ecommerce business, including:

Marketing Attribution

With the attribution capabilities of advertising platforms increasingly degraded, it’s critical for merchants to develop independent mechanisms to validate 3rd party performance reporting and accurately measure the true ROI of their marketing programs.

With post-purchase surveys, merchants can continuously collect marketing attribution insights directly from consumers, including immediately after a purchase has been completed.

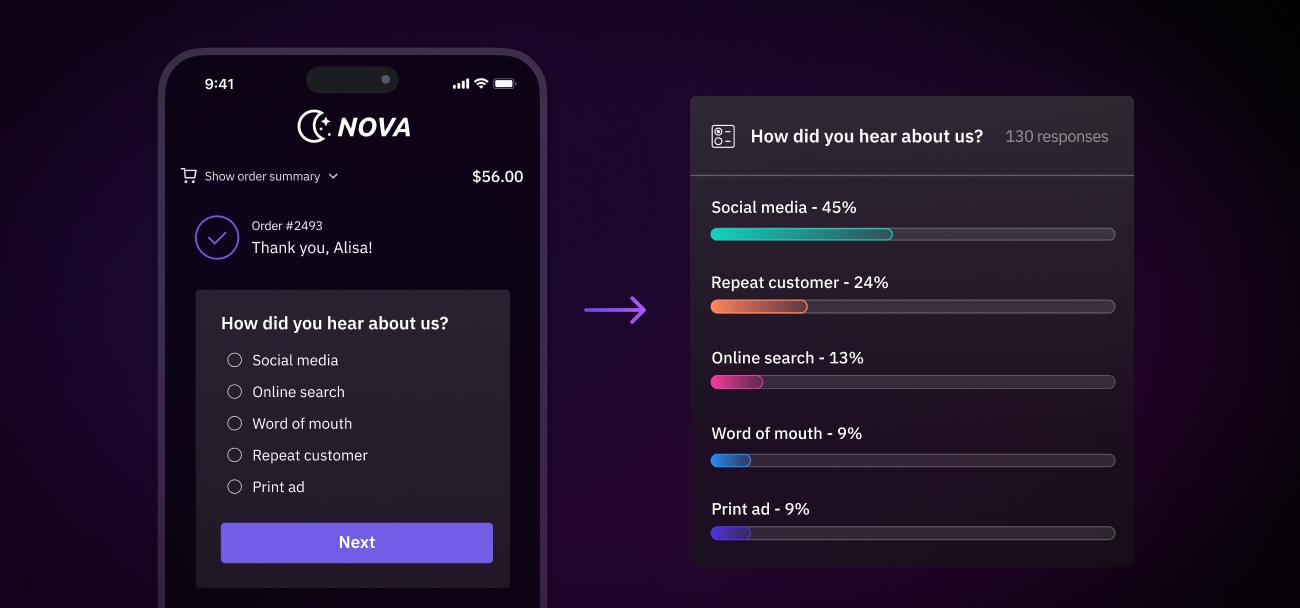

By using post-purchase surveys to ask customers questions like “How Did You Hear About Us?” merchants can use these “ground truth” attribution insights to identify and measure the performance of channels, scale up high ROI marketing efforts and scale down poor performers.

Customer Satisfaction

Post-purchase surveys have become a staple for measuring customer satisfaction and the overall customer experience (CX). They allow brands to accurately measure key metrics from surveys like NPS, CES, and CSAT when engagement is at peak levels—which is a primary reason why post-purchase has such high response rates.

With solutions like Okendo Surveys, simple yet powerful post-purchase micro-surveys act as a continuous CX monitoring and measurement program. This allows you to keep a pulse on customer satisfaction, as well as identify specific drivers of both customer frustration and happiness. This, in turn, can help you develop the best strategies for building customer loyalty.

Profile Completion

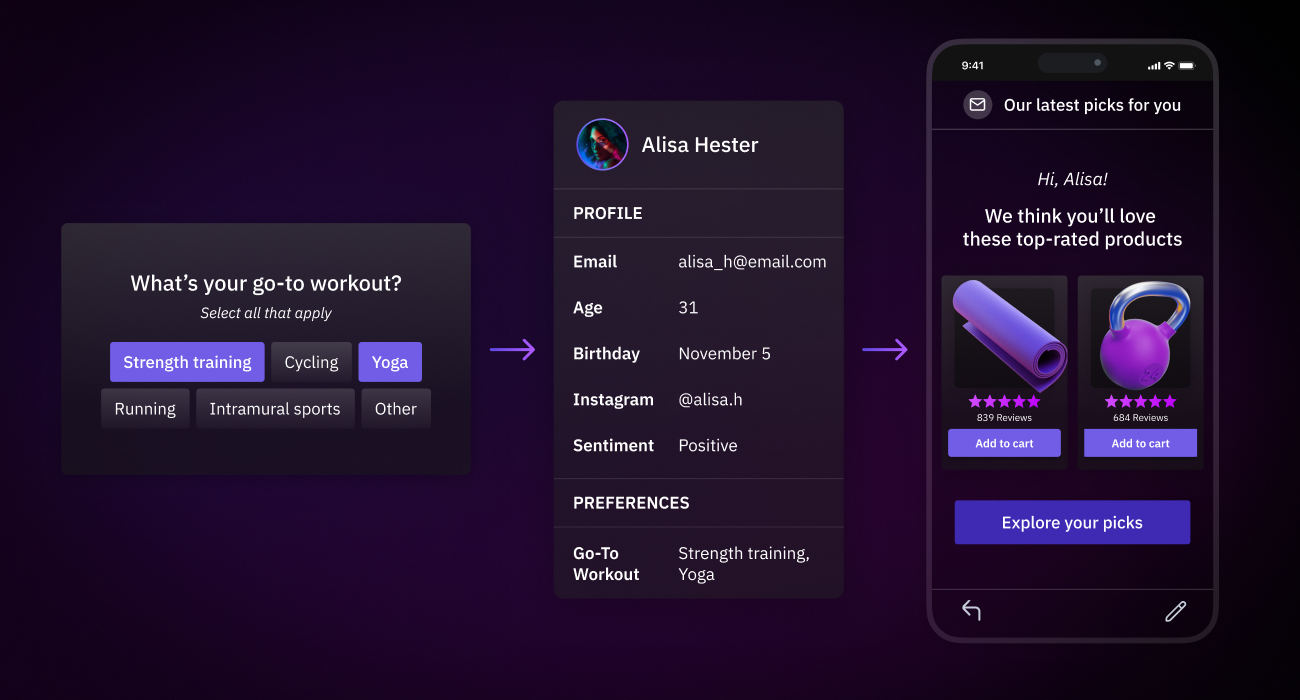

Aside from keeping a pulse on customer feedback, the overall customer experience, and effectiveness of your marketing strategies, post-purchase surveys are valuable tools when it comes to gaining zero-party data from your customers that can be used to enrich customer profiles.

Brands can use them to gather immediately actionable insights about new customers such as purchase intention, demographics, and more to create more robust profiles for existing customers. For example, fitness brands can use post-purchase surveys to ask questions about customers’ fitness goals, challenges, and daily routines. This broader understanding leads to stronger relationships by allowing you to personalize offerings and content that cater to them as unique individuals, not just customers.

Customer Journey Mapping

While online shoppers can buy products with the click of a button, the truth is that there’s a much larger journey taking place behind the scenes.

Customer journey mapping (CJM) allows brands to visually represent this journey through the individual steps customers are taking from beginning to end. Of course, a brand can complete some of these steps based on generalized knowledge and high-level data, but doing so will surely leave gaps. And these blindspots are often where the magic happens. Specifically, it’s where the opportunity lies to turn a mediocre purchasing experience into a positive one, and convert a one-time buyer into a loyal customer.

Post-purchase surveys allow you to go straight to the customer for real-time feedback to fill in these gaps and deepen your understanding of the journeys they are taking. For example, using a post-checkout survey to ask a customer “What are some ways we can improve our shopping experience?” could yield responses that shed light on a ‘clunky web experience’ or ‘lack of customer service’. This valuable feedback, which otherwise might have never been given, enables you to better understand the experiences that customers are having, improve their journeys, and ensure satisfied customers.

Post-Purchase Survey Best Practices

Here are some important best practices that will enable you to maximize the value of your post-purchase surveys.

Focus on Customer Experience

The reason why most surveys fail is pretty simple — they erode the customer experience by making customers jump through unnecessary hoops to provide feedback. By keeping the customer experience at the center of your post-purchase survey strategy, you optimize your opportunity to collect insightful and actionable feedback.

Key to this is using in-moment micro-surveys — consisting of one to three questions that are delivered at highly-relevant moments — that allow you to maximize engagement and ensure you’re meeting the expectations of your customers without disrupting the buyer’s journey. From the templates you choose to the questions you ask, make sure your surveys are pulling through your brand and adding to the customer experience.

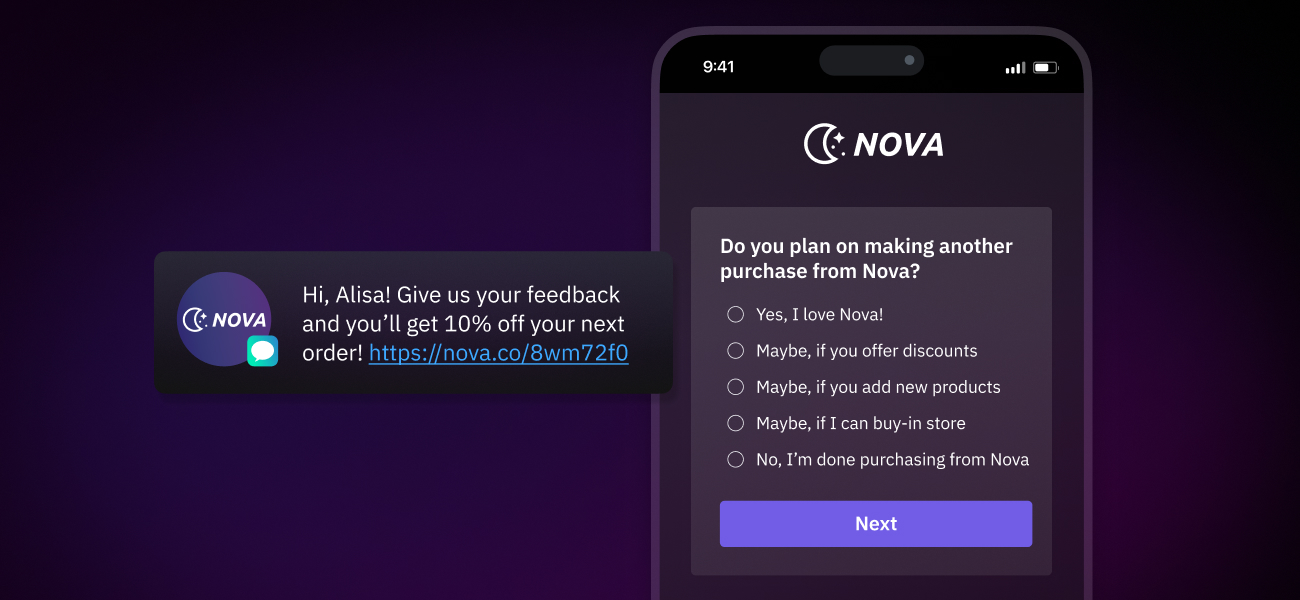

Offer Incentives for Completion

By adding automated incentives for completing a survey, brands can maximize the amount of relevant data they capture about their customers. Additionally, using incentives such as coupons can be an effective driver of future purchases and work to improve customer lifetime value.

Leverage Multi-Channel Surveys

Many ecommerce brands mistakenly assume that the post-purchase survey is the same thing as a post-checkout survey that appears on an order confirmation page. However, the post-purchase survey is much more flexible than that of one particular use case.

With the right post-purchase tools, brands can send surveys across several channels, giving them multiple relevant touch points that span well beyond the post-checkout page. For example, with Okendo Surveys, ecommerce teams can send post-purchase surveys across the following channels:

Post-Checkout Surveys:

In many ways, post-checkout surveys are the default post-purchase survey. And while brands would do well to broaden their post-purchase insights strategy, the truth is that post-checkout surveys can be extremely effective.

Timing is everything when it comes to gathering customer feedback. The less engaged your customer is when you send them a survey, the less insightful and actionable the feedback is. The reason that post-checkout surveys have become a staple of the post-purchase stage is that they allow teams to capture feedback when engagement is at its highest. You’re simply never going to capture someone’s attention as much as you do when they’ve just made a purchase. This is why post-checkout surveys are a great tool for gathering key metrics from surveys like How Did You Hear About Us, NPS, CES, and CSAT.

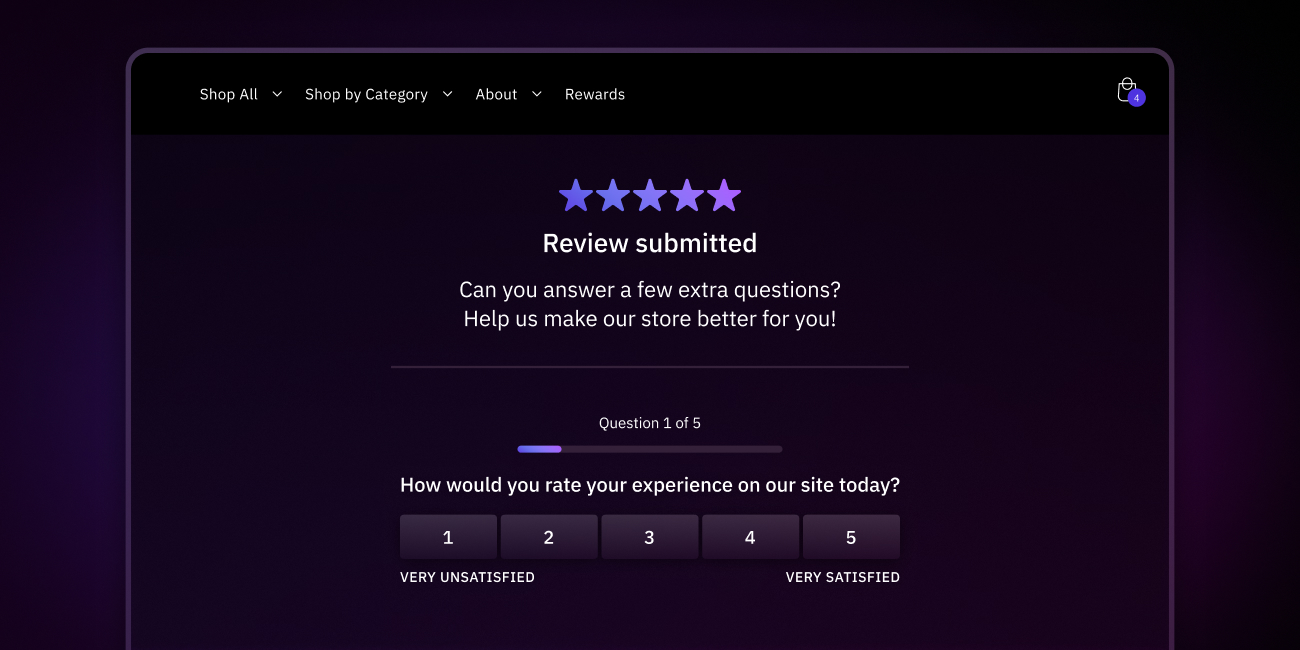

Post-Review Surveys:

Surveying customers after they leave a review is a no-brainer for a couple of reasons. Not only does including surveys in review submission forms allow you to capitalize on peak levels of engagement, but it also enables you to hone in on important areas based on the review itself.

For example, if a customer leaves a positive review on a piece of exercise equipment, a brand can include a post-review survey in the submission forms that digs deeper into the types of products or routines that a happy customer is interested in. This insight can then be used for upsell or cross-selling opportunities.

And if the review is negative, the post-review survey can dig deeper into the customer experience and allow teams to swoop in for powerful service recovery opportunities, improving customer retention.

Shareable Link Surveys:

Today’s consumer is bombarded with content and communications from many brands making it hard to get their attention, let alone their engagement. This makes the ability to create shareable links for post-purchase surveys that can be embedded into existing customer journeys such as email and SMS indispensable.

Just because your customer doesn’t complete a post-checkout survey on the order confirmation page or post-purchase survey questions in a follow-up email, doesn’t mean that they don’t want to give you feedback. More often than not, it comes down to the fact that they are busy or missed it altogether. Sending a friendly text with a link to a survey and possibly a reward for completing it might be all that’s needed to grab their attention to get the insights you need.

How to Target Post-Purchase Surveys: Zeroing In

Surveys fail when they are delivered out of context. And in reality, this happens way more than it should.

In order for brands to collect the most relevant and actionable customer intelligence, they need to hone in on specific audiences with specific questions. With Okendo’s contextual targeting feature, brands get an extensive range of specific events and behavioral triggers for determining exactly when a survey should be displayed to audiences. These can be things like page load, time on page, exit intent, or adding or removing items to cart. Here’s a look at a few ways how this would work.

For post-checkout surveys, a merchant could set a trigger for a survey to display only for New Customers. This would allow them to capture important insights such as attribution data, while ensuring that existing customers are not receiving surveys they’ve probably already taken.

For post-review surveys, teams can set triggers based on review thresholds, ie Review Rating is at most 3 stars, and thus, trigger surveys designed to dig into where the experience fell short and areas of possible improvement. On the flip side, triggers for high performing reviews allow teams to get actionable feedback from brand Promoters.

Brands can also get deeper into a specific customer set by targeting them based on their demographics or interests. For example, if a customer makes a purchase for a dog toy, the brand might trigger a post-checkout survey that asks the customer what type of breed they own. When they’re armed with this type of information, teams can automate it to the customer profile and use it to personalize marketing efforts going forward.

As these examples illustrate, contextual targeting enables merchants to maximize engagement, minimize friction, avoid drop off and create engaging surveys that deliver only the most relevant and actionable insights.

Questions to Ask in Post-Purchase Surveys

Now that we’ve dug into all the reasons why your brand needs post-purchase surveys and tips for maximizing their value, let’s take a look at some questions you might consider asking as part of your next post-purchase survey. Remember: the most simple survey questions often deliver the most compelling data!

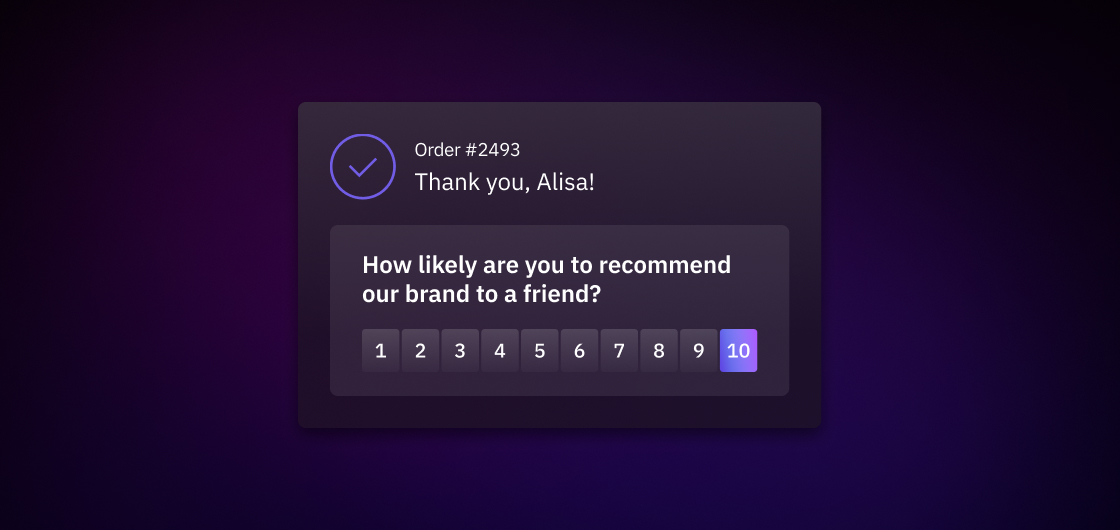

- How Likely Are You to Recommend Us to a Friend?

This one is the de facto question for measuring NPS. Depending on the rating which is between 0 (not at all likely) and 10 (extremely likely), you can categorize your customers as promoters (those who respond with a score of either 9 or 10), passives (those who respond with a score of either 7 or 8), and detractors (those who score you between 0 and 6).

- On a Scale of 1-10, How Would You Rate Our Customer Service?

- Did the Overall Customer Experience Meet your Expectations?

The above questions are a great way to measure customer satisfaction. You can easily tailor these questions based on what exactly you want your customer to rate. For example, you could just ask them about your checkout experience.

- How Did You Hear About Us?

This is an incredibly simple question with the potential to shift your entire marketing strategy. By asking this question, you can better understand the effectiveness of your marketing campaigns and decipher which channels are contributing the most to brand awareness, website traffic, and sales. And with solutions like Okendo Surveys, Question Logic tools allow you to drill further into where exactly your customers are coming from. For example, if they chose “Podcast”, a follow-up question could display a list of podcasts for them to choose from, giving you a more precise idea of the channels driving customers. As always, the more exact your insights are, the more action you can take action on them.

- Why Did You Buy From Us?

In the age of cut-throat competition, this is a useful question to ask as it helps you to determine your brand differentiators in the eyes of your customers. You can give your customers a list of answer options: price; free shipping; promotions; friend referral; product reviews; you came up first in my search; you had the specific item I was looking for in stock.

- Tell Us What You Love or What We Could be Doing Better

Similar to the above, asking this open-ended question helps you establish your brand’s strengths. But perhaps more importantly, it helps you to identify your weaknesses in the eyes of your customer.

- How Do You Want Us to Connect With You in the Future?

Again, this question will help you optimize marketing to ensure you’re targeting customers where they want to be reached. You can also inquire about frequency, or ask direct questions regarding product satisfaction.

Now that we’ve nailed down our questions, we wanted to show you how easy it is to set up a post-purchase survey using Okendo Surveys.

Post-Purchase Survey Examples

Here are post-purchase survey examples from fast-growing Shopify brands to inspire survey question ideas to know what your customers want, identify brand advocates, and understand where they first learn about your brand.

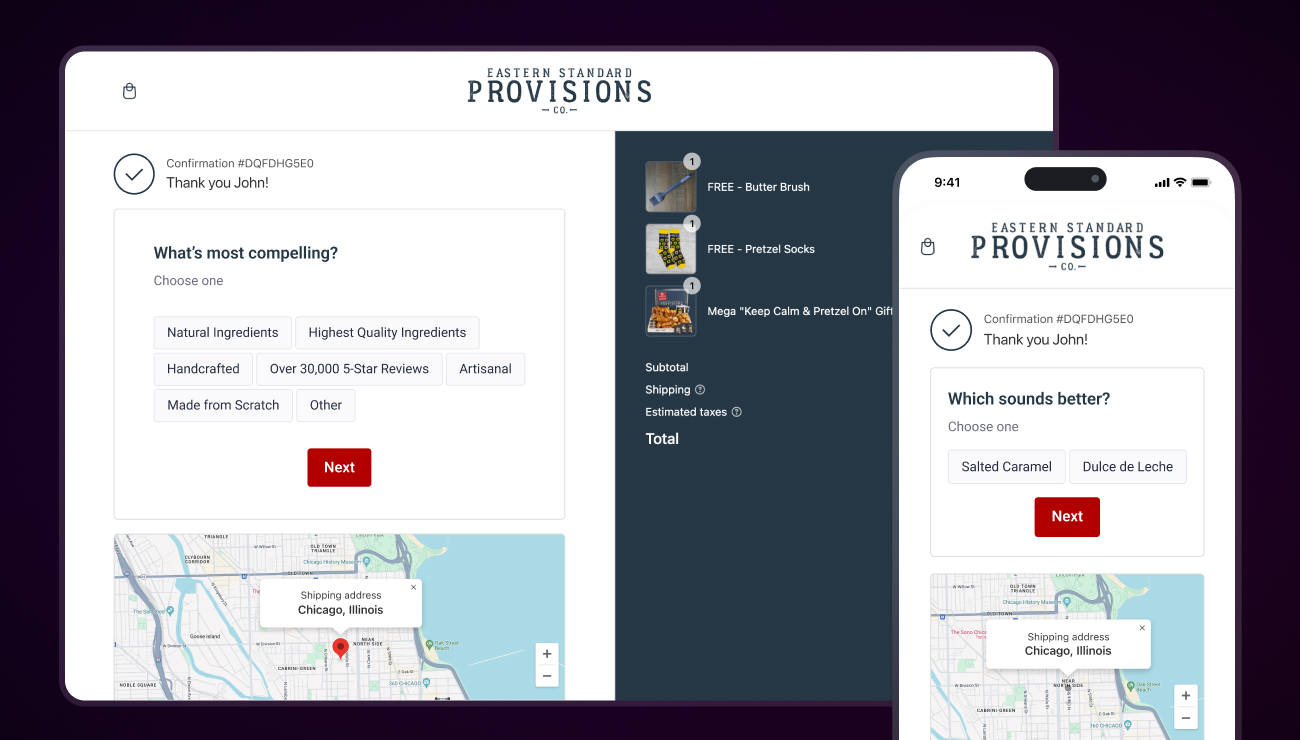

Eastern Standard Provisions

Eastern Standard Provisions uses the highest quality ingredients for their expertly crafted, one-of-a-kind Artisanal Soft Pretzels, Liege Belgian Waffles, and toppings. They have more than 40,000 5-star reviews.

The team at Eastern Standard Provisions was looking to know their customers on a deeper level.

They use several different types of surveys with Okendo Surveys to gather various kinds of insights and feedback. They use marketing attribution as one of their surveys, for example. They ask customers, “How Did You Hear About Us?” This question revealed that 38% of customers come from paid social.

Post-purchase customers were asked, “What’s the most compelling claim?” The team then quickly learned with certainty that “Highest Quality Ingredients” is the key in the brand’s messaging.

Customers also helped the team decide on future waffle and current pretzel flavors through Surveys. The survey was simple, asking customers, “Which sounds better?” with the choices of Salted Caramel or Dulce de Leche.

Why were these surveys important? They helped Eastern Standard get the real-time research they needed to guide product development decisions and messaging. The information came directly from the most important source of information — the customer.

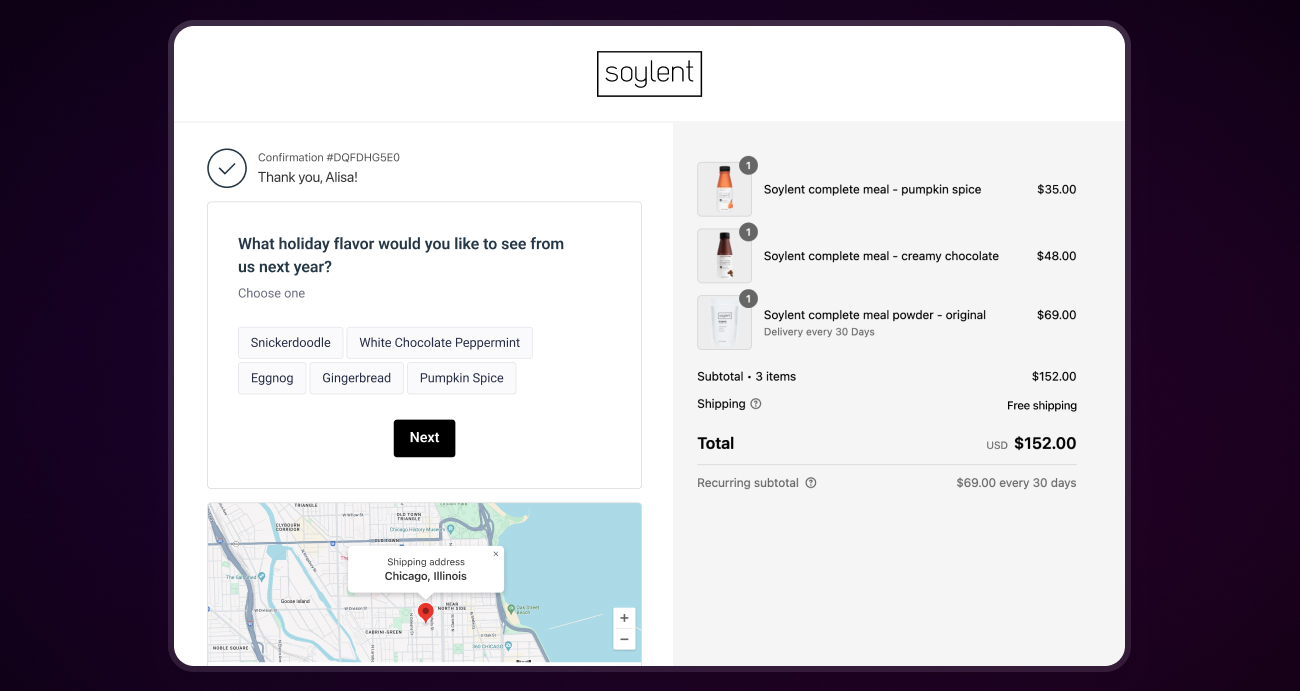

Soylent

Soylent began with the straightforward idea that complete nutrition should be accessible and affordable. Founded by software engineers who crossed paths in Silicon Valley, they realized that their diet of unhealthy meals could be improved. This led to the hypothesis that food could be simplified for the better. Soylent offers a science-based and sustainable complete plant protein.

Soylent moved to Okendo from Fairing to get high response rates across the entire customer journey. They needed to get responses fast and at high volume for data quality.

In one post-purchase survey, the team at Soylent asked customers, “What flavor would you like to see from Soylent?” Customers had a choice between flavors. The Soylent team found that the flavors that resonated with customers were not expected. This survey helped the team inform product strategy.

They also distributed an important post-purchase marketing attribution survey to understand where to focus their spend. They learned that 30-40% of customers find their product in retail stores using Okendo Surveys. With this data from the purchasing process, the team confidently decided to work with Aisle to incentivize customers who drop off on the store website to try the product in a retail store before committing to a purchase onsite.

The results with Okendo Surveys? A 20% response rate. In addition, the team saves time by sending discount codes automatically once a survey is completed. Before Okendo, their small team was manually sending these codes to customers.

How to Set Up A Post-Purchase Survey with Okendo Surveys

You can choose to create a survey from scratch, clone an existing survey, or choose from several templates like ‘How Did You Hear About Us’ to quickly deploy a survey to your customers.

Follow these steps to create a survey:

- Open your Okendo app.

- Click Surveys in the sidebar.

- Click the + Create New button on the Survey List page.

- Choose a template and then click Continue.

- Enter a unique name for your survey.

- Configure your questions and add conditional logic if needed.

- Click Save and Add.

There are nine different question types to choose from, and you can add a combination of these questions to your survey. If you choose one of the survey templates that includes pre-configured questions, you can modify these questions to fit your needs.

Our question types include:

- Multi-select. Participants can select multiple answers to a single question.

- Single-select. Participants can select only one answer for a single question.

- Rating. Participants can select between one and five stars to rate their experience.

- Five-point. Participants can assign a numerical value to rate their experience.

- NPS. Empowers you to capture and measure the likelihood that your customers would recommend your store.

- Free text. Participants can type an answer to your question.

- Content page. Allows you to create a separator between questions if you intend to ask your participants different sets of questions. This question type works for longer surveys with more questions so you can break it up into categories and sections.

- Profile question. Allows you to ask personalized questions to learn more about your customers. You can also use profile questions to collect customer profile attributes when you embed this question type in your review process.

After you’ve created your survey and previewed how it will appear to your participants, you can add it to a post-checkout, post-review, or shareable links channel, configure a reward, and distribute it to your customers.

The post-purchase stage is your chance to make sure that all of the time and resources you’ve committed to your business are being used in the right way. It’s also an opportunity to form stronger relationships with your customers. For these reasons, even though the post-purchase stage begins the moment after a customer buys something, it should never be treated as an afterthought. Indeed, with the right tools and post-purchase survey strategy in place, brands can pave the way toward continued success. Book a demo, or visit the Okendo Surveys product page to learn more.

Post-Purchase Surveys FAQ

What are post-purchase lifecycle surveys?

Post-purchase lifecycle surveys are strategic questionnaires deployed at various stages after a customer makes a purchase. They help brands:

- Measure customer satisfaction

- Gather valuable feedback on products and services

- Collect zero-party data for personalization

- Map customer journeys more accurately

- Identify areas for improvement in the buying process

When is the best time to send post-purchase surveys?

The optimal timing varies based on survey objectives:

- Immediate post-checkout: For feedback on the shopping experience

- Post-delivery (2-3 days): For shipping and delivery feedback

- Product usage (1-2 weeks): For product satisfaction insights

- Long-term (30+ days): For loyalty and retention metrics

What metrics should I track with post-purchase surveys?

Key metrics to monitor include:

- Net Promoter Score (NPS)

- Customer Satisfaction Score (CSAT)

- Customer Effort Score (CES)

- Marketing attribution data

- Product satisfaction rates

- Customer demographic information

How can I improve survey response rates?

Effective strategies include:

- Keeping surveys brief (1-3 questions)

- Offering incentives (discounts, loyalty points)

- Using multi-channel distribution (email, SMS, on-site)

- Personalizing survey timing and content

- Making surveys mobile-friendly

- Following up with non-respondents

How do I analyze and act on survey results?

Best practices for survey analysis:

- Aggregate responses by customer segments

- Identify common patterns and trends

- Track changes over time

- Create action plans for addressing feedback

- Share insights across departments

- Implement changes based on customer input

What types of questions should I include in post-purchase surveys?

Effective question types include:

- Marketing attribution (“How did you hear about us?”)

- Product satisfaction ratings

- Open-ended feedback opportunities

- Purchase motivation questions

- Future product interest

- Communication preferences

How do post-purchase surveys impact customer retention?

Post-purchase surveys can boost retention by:

- Identifying at-risk customers early

- Personalizing future interactions

- Demonstrating customer value

- Building stronger relationships

- Informing product improvements

- Creating opportunities for service recovery

What are the technical requirements for implementing post-purchase surveys?

Essential components include:

- Survey software integration

- Email marketing platform

- Customer data platform

- Analytics tools

- Response tracking capability

- Automation workflows

How do I measure ROI from post-purchase surveys?

Track these metrics to measure survey ROI:

- Customer retention rates

- Repeat purchase frequency

- Customer lifetime value

- Issue resolution rates

- Product improvement impacts

- Marketing efficiency improvements

What are common mistakes to avoid with post-purchase surveys?

Key pitfalls to avoid:

- Surveys that are too long

- Poor timing in the customer journey

- Lack of mobile optimization

- Not acting on feedback

- Over-surveying customers

- Generic, non-personalized questions

Ready to learn more?